29+ deductible mortgage interest

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Premium Photo Reserve Fund Is Shown On A Conceptual Photo Using Wooden Blocks

16 2017 then its tax-deductible on.

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. 13 1987 your mortgage interest is fully tax deductible without limits. Divide the cost of the points paid by the full term of the loan in.

Web are refinance fees tax deductible home refinance tax implications mortgage interest deduction refinancing mortgage interest deduction limit mortgage interest limitation. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Most homeowners can deduct all of their mortgage interest. 30 x 12 360. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web What counts as mortgage interest. For borrowers who want a shorter mortgage the average rate on.

Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web If you took out your mortgage on or before Oct. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be.

However higher limitations 1 million 500000 if married. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Ad Shortening your term could save you money over the life of your loan.

Homeowners who are married but filing. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Also if your mortgage balance is.

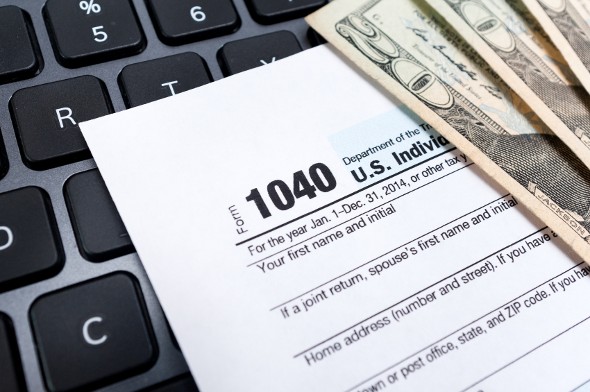

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for. Web 2 days agoThe current average rate on a 30-year fixed mortgage is 719 compared to 712 a week earlier.

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest What S Deductible Now And Should I Refinance Baker Newman Noyes

What Is Mortgage Interest Deduction How Does It Work Total Mortgage

Home Mortgage Loan Interest Payments Points Deduction

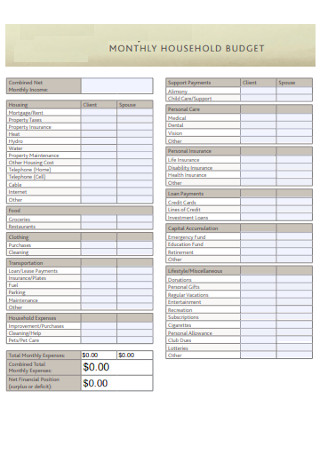

29 Sample Monthly Household Budgets In Pdf Ms Word

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf 83140529 Engineering Economic Analysis Solution Manual By Mjallal مالك العتمي Academia Edu

What Is The Mortgage Interest Deduction The Motley Fool

Maximum Mortgage Tax Deduction Benefit Depends On Income

The Real Estate Weekly 11 04 2020 By The Real Estate Weekly Issuu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

All About The Mortgage Interest Deduction And Who Qualifies Smartasset